APLD

29.56 ((-2.33%))

LMT

496.87 ((-4.82%))

INTC

42.63 ((+6.52%))

BTC-USD

89,882.09 ((-2.26%))

BX

153.59 ((-5.57%))

INTC

42.63 ((+6.52%))

NVDA

189.11 ((+0.98%))

OPEN

6.12 ((-11.69%))

COMP

11.84 ((+9.33%))

AAL

15.99 ((+2.04%))

Trending tickers

| Symbol | Name | Price | Change | Change % | Volume | Avg Vol (3M) | Market Cap | P/E Ratio (TTM) | 52 Wk Change % |

|---|---|---|---|---|---|---|---|---|---|

| QUBT | Quantum Computing Inc. | 7.09 +1.60 (+29.14%) | +1.60 | +29.14% | 43.896M | 32.475M | 972.578M | - | 471.77% |

| RGTI | Rigetti Computing, Inc. | 11.22 +2.47 (+28.23%) | +2.47 | +28.23% | 125.742M | 134.886M | 3.207B | - | 452.71% |

| QBTS | D-Wave Quantum Inc. | 10.15 +3.24 (+46.89%) | +3.24 | +46.89% | 259.529M | 84.691M | 2.706B | - | 331.91% |

| QSI | Quantum-Si incorporated | 1.3600 +0.2200 (+19.30%) | +0.2200 | +19.30% | 20.614M | 26.813M | 249.07M | - | -28.80% |

| IONQ | IonQ, Inc. | 25.00 +3.63 (+16.99%) | +3.63 | +16.99% | 37.559M | 25.676M | 5.972B | - | 162.05% |

| NAOV | NanoVibronix, Inc. | 2.2059 -0.4165 (-15.88%) | -0.4165 | -15.88% | 586,669 | 346,259 | 1.748M | - | -77.72% |

| AFRM | Affirm Holdings, Inc. | 50.08 +3.18 (+6.78%) | +3.18 | +6.78% | 6.272M | 6.885M | 16.03B | - | 46.39% |

| BBAI | BigBear.ai Holdings, Inc. | 3.5300 +0.2600 (+7.95%) | +0.2600 | +7.95% | 54.761M | 63.61M | 887.986M | - | 59.73% |

| WKHS | Workhorse Group Inc. | 2.6025 +2.3961 (+1,160.90%) | +2.3961 | +1,160.90% | 5.903M | 256,654 | 8.532M | - | -95.84% |

| ACON | Aclarion, Inc. | 0.7720 +0.0870 (+12.70%) | +0.0870 | +12.70% | 13.931M | 4.238M | 784,267 | - | -99.33% |

| AMD | Advanced Micro Devices, Inc. | 100.97 +2.86 (+2.92%) | +2.86 | +2.92% | 24.715M | 38.999M | 163.62B | 100.97 | -47.04% |

| SES | SES AI Corporation | 0.4398 +0.0367 (+9.10%) | +0.0367 | +9.10% | 19.242M | 30.544M | 160.377M | - | -69.44% |

| LAES | SEALSQ Corp | 3.3200 +0.5800 (+21.17%) | +0.5800 | +21.17% | 24.055M | 40.093M | 351.95M | - | 89.71% |

| KULR | KULR Technology Group, Inc. | 1.4500 +0.1800 (+14.17%) | +0.1800 | +14.17% | 17.786M | 27.647M | 346.955M | - | 866.67% |

| ZIM | ZIM Integrated Shipping Services Ltd. | 18.24 +0.27 (+1.50%) | +0.27 | +1.50% | 8.028M | 5.59M | 2.197B | 1.02 | 91.19% |

| PLTR | Palantir Technologies Inc. | 86.24 +6.62 (+8.31%) | +6.62 | +8.31% | 113.985M | 99.512M | 202.264B | 453.89 | 259.33% |

| NVDA | NVIDIA Corporation | 121.67 +6.09 (+5.27%) | +6.09 | +5.27% | 277.593M | 271.875M | 2.969T | 41.38 | 37.55% |

| SOUN | SoundHound AI, Inc. | 10.34 +1.43 (+16.05%) | +1.43 | +16.05% | 41.929M | 59.663M | 4.125B | - | 25.49% |

| NAAS | NaaS Technology Inc. | 1.0200 +0.0400 (+4.08%) | +0.0400 | +4.08% | 569,471 | 1.814M | 14.059M | - | -95.49% |

| NCLH | Norwegian Cruise Line Holdings Ltd. | 19.19 +0.66 (+3.56%) | +0.66 | +3.56% | 10.988M | 11.142M | 8.443B | 10.15 | -2.34% |

| INCY | Incyte Corporation | 67.86 +0.15 (+0.22%) | +0.15 | +0.22% | 1.29M | 1.641M | 13.133B | 452.40 | 18.35% |

| SUNE | SUNation Energy Inc. | 0.5250 +0.2051 (+64.11%) | +0.2051 | +64.11% | 513.957M | 20.078M | 2.307M | - | -98.82% |

| LYT | Lytus Technologies Holdings PTV. Ltd. | 0.1119 -0.0281 (-20.07%) | -0.0281 | -20.07% | 8.564M | 9.662M | 3.481M | 0.00 | -97.89% |

| DXYZ | Destiny Tech100 Inc. | 33.30 +3.94 (+13.42%) | +3.94 | +13.42% | 444,748 | 948,053 | 362.301M | 195.88 | 270.00% |

| ANNX | Annexon, Inc. | 2.6000 +0.0700 (+2.77%) | +0.0700 | +2.77% | 820,768 | 1.304M | 285.246M | - | -58.66% |

News

AMD shares fell 3.1% after showcasing new AI products at CES, putting its AI chip roadmap in focus against competitors like Nvidia and Intel. The company announced its next earnings report for February 3rd, and investors are closely watching for proof that new accelerator chips are translating into sustained sales. The broader market rose, but AMD faces pressure to show faster traction in AI deployments given Nvidia's continued rapid advancements.

PayPal Holdings, Inc. (PYPL) has launched its Transaction Graph Insights & Measurement Program, initially available in the U.S. with plans to expand to the UK and Germany. Additionally, PayPal introduced new advertising solutions at CES 2026, signaling its expansion into the digital advertising sector.

T-Mobile USA has increased its revolving credit facility from $7.5 billion to $10 billion and extended its maturity date to January 5, 2031, through a new credit agreement with JPMorgan Chase Bank. The agreement outlines interest rates based on benchmark rates plus margins and includes a $1.5 billion letter of credit sub-facility and a $500 million swingline loan sub-facility. T-Mobile US, the parent company, guarantees these obligations, and the agreement incorporates standard restrictions and a leverage ratio requirement.

Shares of several semiconductor companies, including Analog Devices, Applied Materials, KLA Corporation, Monolithic Power Systems, and onsemi, surged in the afternoon session amidst a broader market rally driven by optimism in artificial intelligence and big tech stocks. This upward movement was further supported by hopes for easier monetary policy from the Federal Reserve. Analog Devices, in particular, reached a new 52-week high, continuing a strong performance since the beginning of the year.

Synopsys (SNPS) shares rose 2.9% to $508.47, driven by renewed AI optimism in the chip sector and the company's announcements at CES 2026 regarding new automotive engineering partnerships and virtual testing tools. The company highlighted collaborations with Samsung, NXP Semiconductors, Texas Instruments, and Arm, and projected strong fiscal 2026 revenue. Investors are also anticipating CEO Sassine Ghazi's comments at CES and the upcoming earnings report.

GCT Semiconductor Holding Inc. has commenced commercial shipments of its 5G chipset to lead customers following successful qualification and adoption. This milestone, highlighted by Gogo's 5G air-to-ground network launch, positions GCT Semiconductor for significant 5G revenue growth and market penetration in 2026 and beyond. The company completed its "2025GCT - Year of 5G" program on schedule, with commercial shipments beginning at the end of Q4 2025.

Crown Castle Inc. operates the cell towers and fiber infrastructure essential for mobile phone signals and 5G in the US. The article explores whether the stock, structured as a REIT with a significant dividend, is a valuable long-term income play or a potential value trap for investors. It discusses the company's business model, its competitive landscape against American Tower, and provides a "Cop or Drop" verdict for potential investors interested in infrastructure and passive income.

AMD CEO Lisa Su stated that demand for AI is "going through the roof" and that the cost of individual AI chips can be tens of thousands of dollars. She explained that AMD's AI systems bundle dozens of these high-end chips and companies need massive investments in computing power to remain competitive in the AI market. Su projected that the world will need "10 yottaflops" of computing power in the coming years to keep up with AI's rapid growth.

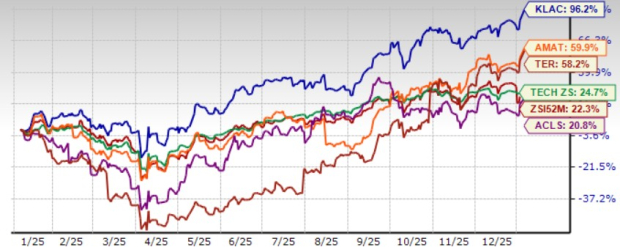

KLA Corporation (KLAC) shares have surged 96.2% over the last year, outperforming the broader tech sector, driven by its leadership in process control, strong AI infrastructure investments, and growth in advanced packaging. The company's prospects are further bolstered by robust demand for leading-edge logic, high-bandwidth memory (HBM), and expected significant growth in advanced packaging revenues. With a Zacks Rank #2 (Buy) and a Growth Score of B, KLA is well-positioned for continued momentum.

Western Digital (NASDAQ: WDC) stock surged 15.8% today after CNBC reported that computer memory chip prices, particularly for DRAM, are set to rise further in 2026 due to AI demand. While Western Digital does not produce DRAM, investors are betting that increasing DRAM prices could lead AI companies to seek cheaper alternatives like HDDs, benefiting Western Digital. Despite the surge, the author suggests Micron (NASDAQ: MU) presents a more compelling bargain due to its higher projected earnings growth rate.

(-5.57%)

(-5.57%)  (+0.98%)

(+0.98%)