World Indices

| Symbol | Name | Price | Change | Change % | Volume |

|---|---|---|---|---|---|

| ^GSPC | S&P 500 | 6,870.40 +13.28 (+0.19%) | +13.28 | +0.19% | 3.146B |

| ^DJI | Dow Jones Industrial Average | 47,954.99 +104.09 (+0.22%) | +104.09 | +0.22% | 459.236M |

| ^IXIC | NASDAQ Composite | 23,578.13 +73.03 (+0.31%) | +73.03 | +0.31% | 7.36B |

| ^NYA | NYSE Composite Index | 21,810.07 -25.73 (-0.12%) | -25.73 | -0.12% | 0 |

| ^XAX | NYSE American Composite Index | 7,193.24 -84.76 (-1.16%) | -84.76 | -1.16% | 0 |

| ^BUK100P | Cboe UK 100 | 968.47 -5.25 (-0.54%) | -5.25 | -0.54% | 0 |

| ^RUT | Russell 2000 Index | 2,521.48 -9.68 (-0.38%) | -9.68 | -0.38% | 0 |

| ^VIX | CBOE Volatility Index | 15.41 -0.37 (-2.34%) | -0.37 | -2.34% | 0 |

| ^FTSE | FTSE 100 | 9,667.01 -43.86 (-0.45%) | -43.86 | -0.45% | 0 |

| ^GDAXI | DAX P | 24,028.14 +146.14 (+0.61%) | +146.14 | +0.61% | 0 |

| ^FCHI | CAC 40 | 8,114.74 -7.29 (-0.09%) | -7.29 | -0.09% | 0 |

| ^STOXX50E | EURO STOXX 50 I | 5,723.93 +5.85 (+0.10%) | +5.85 | +0.10% | 0 |

| ^N100 | Euronext 100 Index | 1,705.34 -3.78 (-0.22%) | -3.78 | -0.22% | 0 |

| ^BFX | BEL 20 | 5,029.74 +16.39 (+0.33%) | +16.39 | +0.33% | 0 |

| MOEX.ME | Public Joint-Stock Company Moscow Exchange MICEX-RTS | 85.20 -0.11 (-0.13%) | -0.11 | -0.13% | 1.576M |

| ^HSI | HANG SENG INDEX | 26,085.08 +149.18 (+0.58%) | +149.18 | +0.58% | 0 |

| ^STI | STI Index | 4,531.36 -3.78 (-0.08%) | -3.78 | -0.08% | 0 |

| ^AXJO | S&P/ASX 200 | 8,607.90 -26.70 (-0.31%) | -26.70 | -0.31% | 0 |

| ^AORD | ALL ORDINARIES | 8,898.20 -27.90 (-0.31%) | -27.90 | -0.31% | 0 |

| ^BSESN | S&P BSE SENSEX | 85,712.37 +447.07 (+0.52%) | +447.07 | +0.52% | 0 |

| ^JKSE | IDX COMPOSITE | 8,632.76 -7.44 (-0.09%) | -7.44 | -0.09% | 0 |

| ^KLSE | FTSE Bursa Malaysia KLCI | 1,616.52 -4.55 (-0.28%) | -4.55 | -0.28% | 0 |

| ^NZ50 | S&P/NZX 50 INDEX GROSS ( GROSS | 13,529.04 +45.05 (+0.33%) | +45.05 | +0.33% | 0 |

| ^KS11 | KOSPI Composite Index | 4,086.26 -13.79 (-0.34%) | -13.79 | -0.34% | 56,199 |

| ^TWII | TWSE Capitalization Weighted Stock Index | 27,980.89 +185.19 (+0.67%) | +185.19 | +0.67% | 0 |

| ^GSPTSE | S&P/TSX Composite index | 31,311.41 -166.19 (-0.53%) | -166.19 | -0.53% | 267.078M |

| ^BVSP | IBOVESPA | 157,369.36 -7,086.64 (-4.31%) | -7,086.64 | -4.31% | 0 |

| ^MXX | IPC MEXICO | 63,378.30 -336.60 (-0.53%) | -336.60 | -0.53% | 109.971M |

| ^IPSA | S&P IPSA | 10,222.61 +43.21 (+0.42%) | +43.21 | +0.42% | 1.683B |

| ^MERV | MERVAL | 3,046,354.75 -50,045.25 (-1.62%) | -50,045.25 | -1.62% | 0 |

| ^TA125.TA | TA-125 | 3,567.36 +31.66 (+0.90%) | +31.66 | +0.90% | 0 |

| ^CASE30 | EGX 30 Price Return Index | 41,762.40 +420.40 (+1.02%) | +420.40 | +1.02% | 501.057M |

| ^JN0U.JO | Top 40 USD Net TRI Index | 6,649.98 +112.74 (+1.72%) | +112.74 | +1.72% | 0 |

| DX-Y.NYB | US Dollar Index | 98.97 -0.02 (-0.02%) | -0.02 | -0.02% | -- |

| ^125904-USD-STRD | MSCI EUROPE | 2,564.76 -6.50 (-0.25%) | -6.50 | -0.25% | -- |

| ^XDB | British Pound Currency Index | 133.31 +0.06 (+0.05%) | +0.06 | +0.05% | 0 |

| ^XDE | Euro Currency Index | 116.43 -0.02 (-0.02%) | -0.02 | -0.02% | 0 |

| 000001.SS | SSE Composite Index | 3,902.81 +27.02 (+0.70%) | +27.02 | +0.70% | 2.792B |

| ^N225 | Nikkei 225 | 50,347.36 -144.51 (-0.29%) | -144.51 | -0.29% | 0 |

| ^XDN | Japanese Yen Currency Index | 64.38 -0.11 (-0.17%) | -0.11 | -0.17% | 0 |

| ^XDA | Australian Dollar Currency Index | 66.38 +0.27 (+0.41%) | +0.27 | +0.41% | 0 |

News

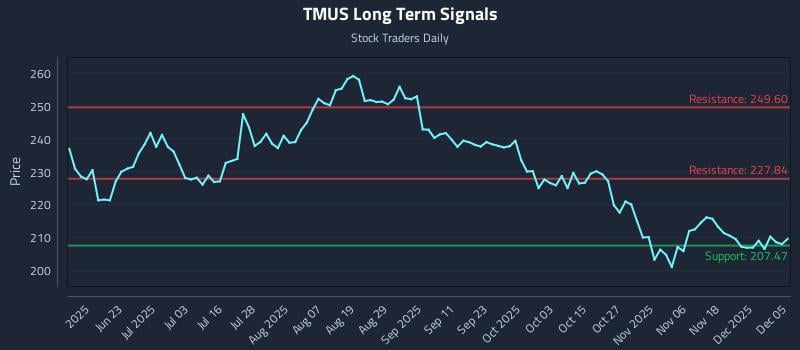

This article details a neutral sentiment for T-Mobile Us Inc. (NASDAQ: TMUS) across all time horizons, suggesting a wait-and-see approach. It outlines three AI-generated trading strategies—Position, Momentum Breakout, and Risk Hedging—with specific entry points, targets, and stop losses. The analysis highlights an exceptional 34.0:1 risk-reward setup, targeting a 9.8% gain against a 0.3% risk.

This article examines the major shareholders and recent insider trading activity of Texas Instruments (NASDAQ: TXN), a leading analog semiconductor company. It details the substantial holdings by large passive institutional investors like Vanguard and BlackRock, highlights significant increases in stakes by several hedge funds, and reviews recent small-scale insider transactions. The analysis indicates that while passive institutions provide long-term stability, active managers show mixed expectations, and insider activity largely comprises administrative entries rather than major shifts in sentiment.

Amundi has significantly increased its stake in Take-Two Interactive Software (NASDAQ:TTWO) by 65.7% in the second quarter, purchasing an additional 361,182 shares. This acquisition brings Amundi's total holdings to 910,959 shares, valued at $218.18 million, representing approximately 0.49% of the company. Other institutional investors have also made substantial investments in TTWO, while the company reported strong earnings, exceeding analyst expectations for the quarter.

Lido Advisors LLC reduced its stake in Western Digital Corporation by 46.9% in Q2 2025, selling 9,956 shares, bringing its total holdings to 11,278 shares valued at approximately $722,000. Despite this reduction and insider selling activities, institutional investors maintain a significant ownership of 92.51% in the company. Analysts have issued an overall "Moderate Buy" rating for Western Digital, with an average target price of $164.70, and the company recently raised its quarterly dividend to $0.125.

California Public Employees Retirement System increased its stake in Intuit Inc. (NASDAQ:INTU) by 8.0% in the second quarter, now holding 860,698 shares valued at approximately $677.9 million. This move comes as Intuit reported strong quarterly earnings, beating analyst estimates with EPS of $3.34 and revenue of $3.87 billion, representing 18.3% year-over-year growth. Despite institutional buying, the company has seen significant insider selling recently, with director Scott D. Cook selling 75,000 shares and total insider sales reaching over $78 million in the past 90 days.

Westpac Banking Corp increased its stake in NVIDIA Corporation by 1.7% in Q2, boosting its holdings to 717,874 shares valued at $113.4 million, making NVIDIA its largest holding. Despite significant institutional ownership, insiders sold a substantial number of shares recently. Analysts maintain a "Buy" rating for NVIDIA with an average target price of $258.65.

Levi & Korsinsky has announced that a class action lawsuit has been filed against Synopsys, Inc. (NASDAQ:SNPS) on behalf of shareholders who suffered losses due to alleged securities fraud between December 4, 2024, and September 9, 2025. The lawsuit claims that Synopsys made false statements and/or concealed information regarding the deteriorating economics of its Design IP business due to increased focus on AI customers. Shareholders affected during this period are encouraged to seek information on potential recovery before the December 30, 2025 deadline.

Burgundy Asset Management Ltd. has significantly trimmed its stake in Electronic Arts (NASDAQ:EA) by 12.3% during the second quarter, now holding 990,457 shares valued at approximately $158.18 million. Despite this reduction, Electronic Arts remains a substantial holding, representing about 1.5% of Burgundy's total portfolio. The article also details recent insider selling, institutional investor activity, financial performance, and analyst ratings for EA.

Jump Financial LLC significantly increased its stake in Intel Corporation by 26.2% in Q2, making INTC its 20th-largest holding. Other major institutional investors also made substantial moves in Intel shares. Despite some analysts raising price targets, the consensus remains cautious with an average "Reduce" rating for the stock.

Franklin Resources Inc. has acquired a new stake in Mercury Systems Inc. (NASDAQ:MRCY), purchasing 17,710 shares valued at approximately $954,000 during the second quarter. This investment highlights continued institutional interest in the technology company, with other firms also adjusting their holdings. The article details several institutional investor activities, stock performance metrics, recent earnings, analyst ratings, and insider transactions for Mercury Systems Inc.

The west must not prevaricate when it comes to seizing Russian reserves

Ruchir Sharma